19, depending on where you live), but will then have until oct. On march 17, 2021, the irs officially extended the federal income tax filing deadline from april 15 to may 17. Hmrc extend filing deadline for 20/21 tax returns to february 2022 hmrc have announced an extension to the january 31st filing deadline for personal tax returns. In Case You’re Just Somewhat Finished With Your Tax Returns And Need More Opportunity To Record, At That Point A Tax Extension Could Be The Ticket For You. In normal years you have until 31 january to file your tax return, but this year the taxman.

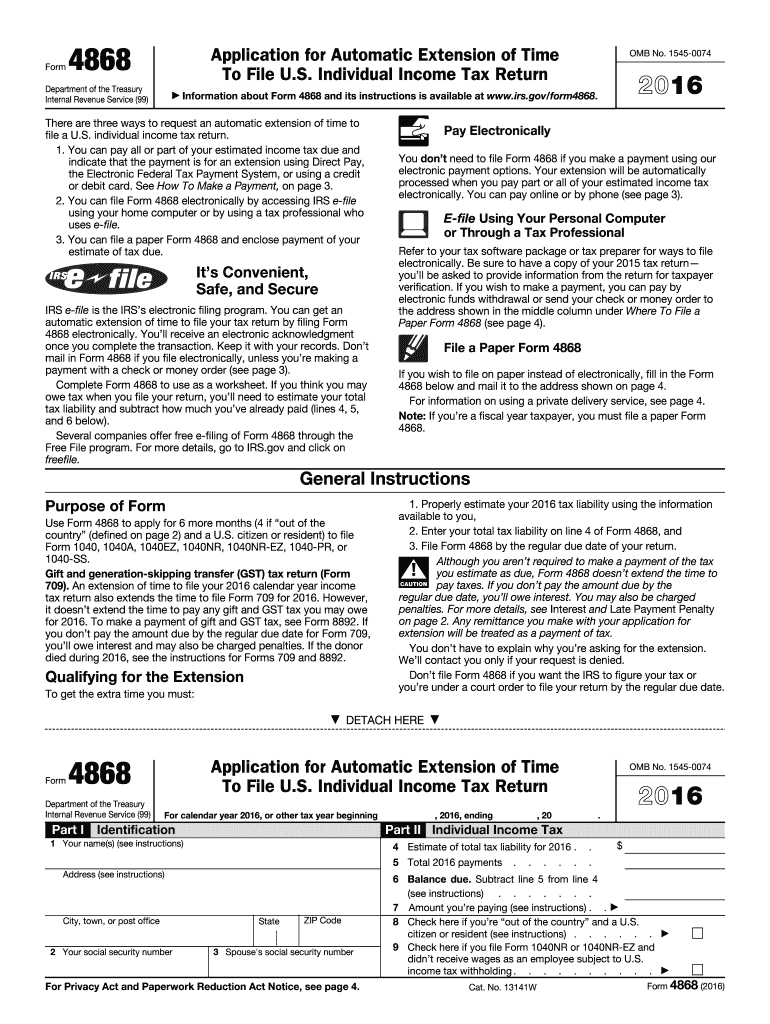

What Is Personal Tax Extension Form 4868. Efile irs form 4868 (application for automatic extension of time to file u.s. Will there be another deadline extension? Tax season is upon us and this year there won't be any deadline extensions. See also 2022 New England Patriots Draft Picks Anyone Who Cannot File Their Return By The 31 January Deadline Will Not Receive A Late Filing Penalty If. This will be a welcome announcement for many agents due to recent staffing issues driven by the number of covid cases this last month. The federal income tax filing deadline is april 18. The Personal Tax Extension Form (Known As The “Application For Automatic Extension Of Time To File U.s.

The current tax year is 2021, with tax returns due in April 2022. For your convenience, provides printable copies of 42 current personal income tax forms from the Maryland Comptroller of Maryland. The actual deadline to file personal tax extension form 4868 is april 15. Maryland has a state income tax that ranges between 2.000 and 5.750. Extensions may be granted (extending the filing deadline through april 18) for good cause, upon written request, filed no later than jan. However, there are some important considerations for state taxes, estimated taxes and certain taxpayers. Extension Form 4868 Usually Allows Taxpayers To Extend Their Personal Income Tax Return Deadlines Up To Six Months. When is the tax extension deadline? The actual deadline to file personal tax extension form 4868 is april 15. See also Mountain View California Minimum Wage 2022įor the 2020 tax year, form 1040 is due on may 17, 2021. What is personal tax extension form 4868. However, for the second year running, hm revenue & customs (hmrc) is waiving late. The penalty waivers will mean that: Anyone who cannot file their return by the 31 january deadline will not receive a late filing penalty if. Possible ITR deadline extension and filing reminders from Taxpayers have to request an extension by apr. 15 deadline approaches for taxpayers who requested extensions to file 2020 tax returns.

#2016 tax extension form printable free

You are free to copy, adapt, modify, transmit and distribute this material as you wish (but not in any way that suggests the ATO or the Commonwealth endorses you or any of your services or products). © Australian Taxation Office for the Commonwealth of Australia

#2016 tax extension form printable professional

If you feel that our information does not fully cover your circumstances, or you are unsure how it applies to you, contact us or seek professional advice.

Make sure you have the information for the right year before making decisions based on that information. Some of the information on this website applies to a specific financial year. If you follow our information and it turns out to be incorrect, or it is misleading and you make a mistake as a result, we will take that into account when determining what action, if any, we should take. We are committed to providing you with accurate, consistent and clear information to help you understand your rights and entitlements and meet your obligations.

0 kommentar(er)

0 kommentar(er)